How Is Workers’ Comp Calculated?

If you have been injured in a workplace accident, you may be wondering just how much Arizona workers’ compensation can help you and how the Industrial Commission of Arizona (the “ICA”) calculates your benefits, and how workers’ comp insurance companies calculate your full and final settlement.

We answer these questions, and others about calculating your workers’ comp benefits, here.

When you are hurt at work, call the Matt Fendon Law Group at (800) 229-3880 for a free strategy session with an experienced Arizona workers’ compensation lawyer.

In addition to consulting with our team, this guide will help you understand how workers’ comp is calculated, who is eligible for benefits, and more.

Calculating Workers’ Compensation Insurance Benefits

If you are injured on the job in Arizona or have suffered a work related illness, the workers’ compensation insurance system provides for you to receive full medical expenses reimbursement for reasonably necessary medical costs and a percentage of your wages while you are unable to work.

Workers’ compensation insurance also offers employees partial income replacement benefits for a limited time if your on-the-job injury, illness, or medical condition prevents you from returning to work.

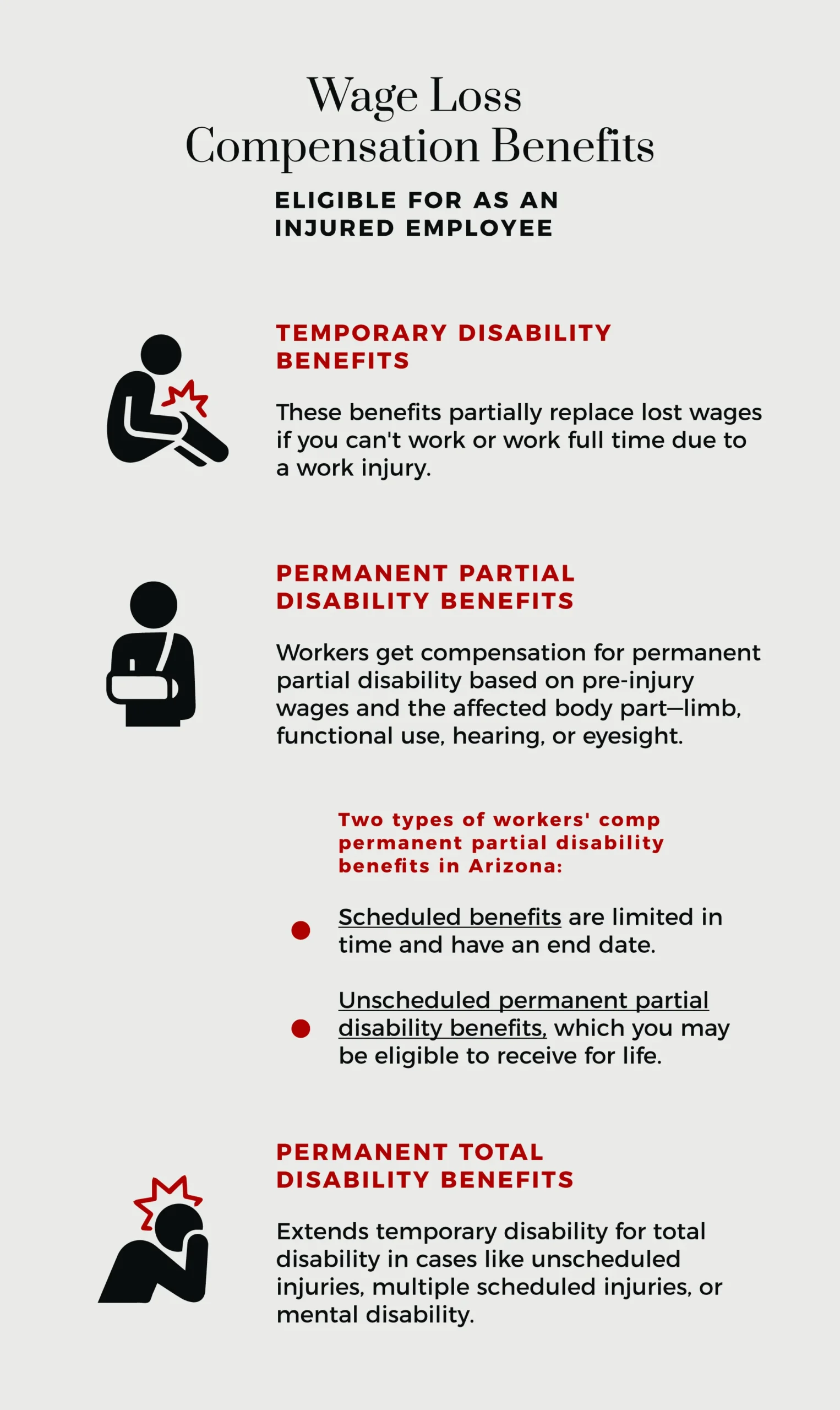

Here are some of kinds of wage loss compensation benefits you might be eligible for as an injured employee:

- Temporary disability benefits. These benefits provide partial replacement for lost wages if you cannot work or cannot work full time because of your work injury.

- Permanent partial disability benefits. Employees can receive these workers’ comp benefits if you have lost a limb or its functional use, or if you have lost hearing or eyesight. Permanent partial disability payments are based on your pre-injury wages, and are paid for a set number of weeks based on the affected body part.

- There are two types of workers’ comp permanent partial disability benefits in Arizona: scheduled and unscheduled. Scheduled benefits are limited in time and have an end date, versus unscheduled permanent partial disability benefits, which you may be eligible to receive for life.

- Permanent total disability benefits. These continue your temporary disability benefits if you are totally disabled and cannot perform any gainful work. To qualify, you must have an unscheduled disability in this category (for example, an injury to your back, shoulder, hips, or head), or multiple scheduled injuries, or a mental disability.

What Is Arizona’s Workers’ Compensation Rate?

Calculating Temporary Disability Benefits

Temporary disability benefits under Arizona’s workers’ compensation program entitle you to receive two-thirds of your pre-injury average monthly wage. How much you can receive is subject to a statutory maximum that the ICA sets every year. This amount increases annually to keep up with inflation.

Lost Earnings Claims for Temporary Disability

Temporary Arizona workers’ compensation insurance claims come in two basic types: medical-only claims, and time-loss claims. Medical-only claims do not involve any benefit claims for being unable to work, they only cover medical bills. Time-loss claims include both medical benefits claims and claims for benefits based on an inability to work.

Time-Loss Claims Eligibility

To qualify for workers’ compensation insurance benefits because you have lost at least some ability to work, you must be found by a doctor to either be unable to work, or to be restricted to light-duty work, for at least seven calendar days. This inability to work must cause you to lose earnings.

Once you clear that threshold, then this is how time-loss calculation works at the beginning:

| Number of lost earning days | Effect on time-loss compensation claim |

| At least 7 | You qualify for time-loss claim compensation, subject to the conditions below. |

| Between 7 and 13 days | If your loss of earnings is for less than 14 days, then you will not receive compensation for the first 7 days.After the first 7 days, you will be eligible for lost earnings compensation for the remainder of the lost earning days. |

| 14 days or more | You are eligible to receive lost earnings compensation for all days you qualify for, including the first 7 days, including the day of the work injury. |

Temporary Total Disability Payments

The general rule in Arizona is that if you have a temporary but total disability, then you receive workers’ compensation benefits at the rate of 66 and ⅔ percent of your average monthly wage:

[Your calculated average monthly wage] x 66.66% = Your temporary disability amount.

Temporary Partial Disability Payments

If you can still work to some extent, such as light-duty work, then the lost earning calculation works differently than it does for a total partial disability. The formula is 66 and ⅔ percent of the difference between your pre-injury wages and your post-injury wages.

Note that to keep light compensation claim eligibility, you must complete a monthly status report of your gross wages.

Arizona Average Monthly Wage Calculation

Your average monthly wage in Arizona is unique to you, up to a certain dollar amount. It is usually the sum of what you received in earnings in the 30 days leading up to the day of your injury, although some other ways exist to calculate it.

Your employer will be the one responsible to calculate and provide to the ICA through its workers’ comp insurance your average monthly income before your injury event at work. One formula your employer can use is to divide your annual wages by the number of days you worked in the same year.

After it receives the average monthly wage information from the employer, the ICA will send you a Notice of Average Monthly Wage.

Your average monthly wage will be either the 30-day calculated sum above or–if you made more than a certain amount the state of Arizona establishes every year–your average monthly wage will be capped at that amount.

Maximum Arizona Average Monthly Wage

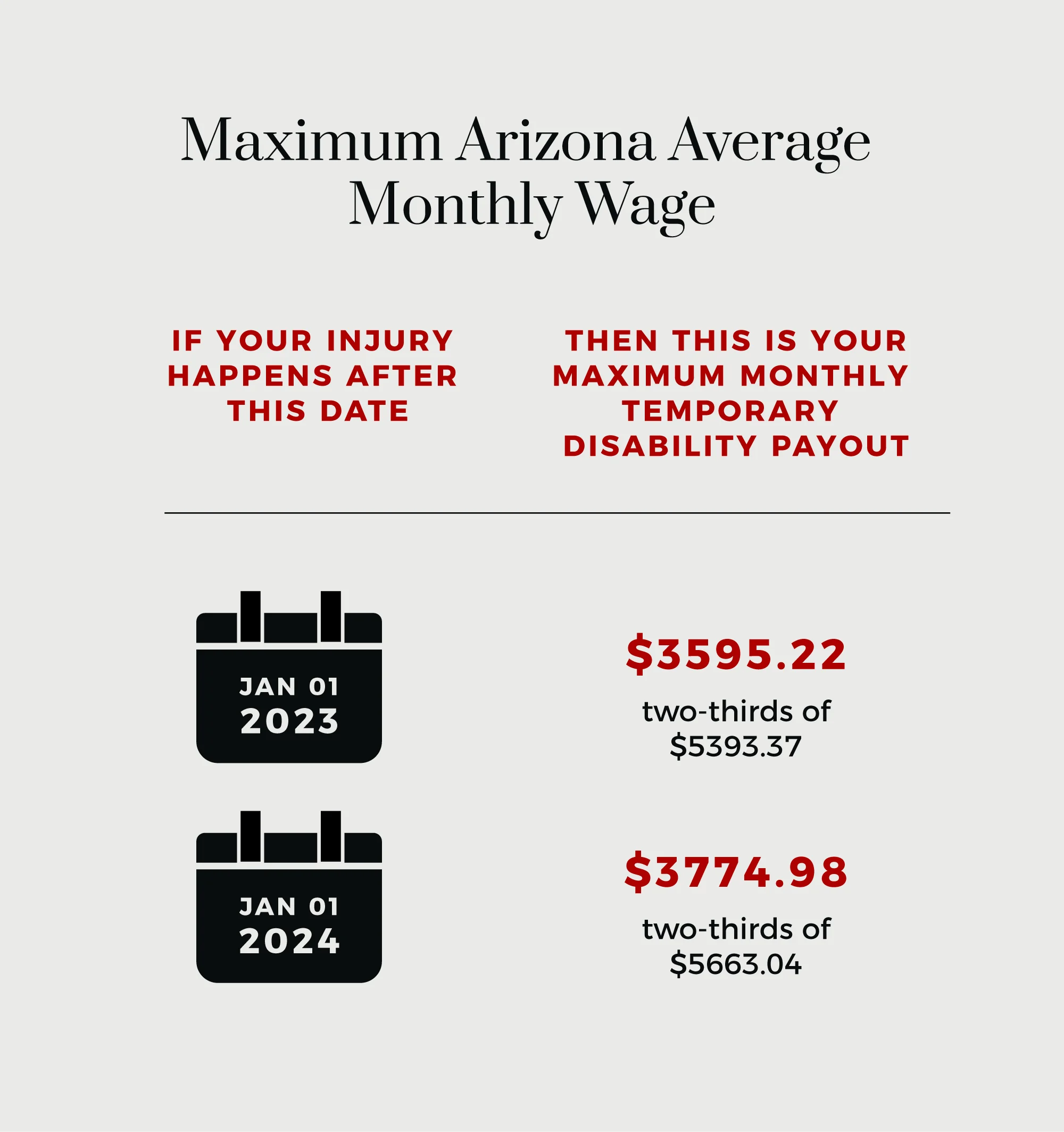

The maximum Arizona monthly wage employees can receive through the end of 2023 for workers’ compensation wage replacement calculation is $5,393.37.

Beginning on January 1, 2024, and continuing through December 31 of that year, this maximum wage increases to $5,663.04.

Using the two-thirds calculation above, the maximum workers’ comp lost earnings benefit you could receive would be:

Calculating Permanent Partial Disability Benefits

Permanent partial disability benefits are paid at 50 percent of your average monthly wage for a partial loss of use of a body part, 55 percent of your average monthly wage for an amputation or total loss of use of a limb, or 75 percent of your average monthly wage if you cannot return to your pre-injury job due to the partial disability.

Unscheduled partial disabilities may entitle employees to receive 55 percent of the difference between your pre-injury average monthly wage and the income you now earn. Unscheduled total disabilities will pay you 66.6% of your average monthly wage for the rest of your life.

Arizona Scheduled Permanent Partial Disability Payments

| Injured Body Part | Months of Compensation |

| Separation or complete loss of use of a thumb | 55% of average monthly wage for 15 months |

| Separation or complete loss of use of a first or “index” finger | 55% of average monthly wage for 9 months |

| Separation or complete loss of use of a second finger | 55% of average monthly wage for 7 months |

| Separation or complete loss of use of a third finger | 55% of average monthly wage for 5 months |

| Separation or complete loss of use of a fourth finger | 55% of average monthly wage for 4 months |

| Loss of one phalange bone in a thumb or finger | Half the period above for the appropriate injury |

| Loss of two or more phalange bones in a thumb or finger | Same as for the loss of the entire corresponding finger. |

| Separation or complete loss of use of a great or “big” toe | 55% of average monthly wage for 7 months |

| Separation or complete loss of use of any other toe | 55% of average monthly wage for 2.5 months |

| Loss of the first phalange of any toe | Half the time period above for the affected toe. |

| Loss of more than one phalange bone in any toe | Same as for the loss of the entire corresponding toe. |

| Separation or complete loss of use of a hand | For loss of the major or “favored” hand, 50 months.For loss of the minor hand, 40 months. |

| Separation or complete loss of use of an arm | For the loss of the major or “favored” arm, 55% of average monthly wage for 60 months.For the loss of the minor arm, 55% of average monthly wage for 50 months. |

| Separation or complete loss of use of a foot | 55% of average monthly wage for 40 months |

| Separation or complete loss of use of a leg | 55% of average monthly wage for 50 months |

| Loss of one eye be enucleation(a surgical procedure that removes the entire globe of the eye and its intraocular contents but leaves the eye muscles and remaining orbital contents intact) | 55% of average monthly wage for 30 months |

| Permanent and complete loss of sight in one eye, without enucleation | 55% of average monthly wage for 25 months |

| Permanent and complete loss of hearing in one ear | 55% of average monthly wage for 20 months |

| Permanent and complete loss of hearing in both ears | 55% of average monthly wage for 60 months |

| Partial loss of use of a finger, toe, arm, hand, foot or leg Partial loss of sight or hearing | 50% of the average monthly wage during the proportional number of months provided for total loss of use of the same finger, toe, hand, foot, or limb. The proportion is based on the proportion of total loss that the partial loss represents.If the worker cannot return to the work that person was performing at the time of the injury, then compensation is 75% of the average monthly wage. |

| Disfigurement of the head or face, including loss of or injury to teeth | 55% of average monthly wage for up to 18 months, if the Commission decides that compensation is just based on proof submitted by the worker. |

Arizona Scheduled Permanent Partial Disability Payments

Unscheduled impairments are those that do not qualify as scheduled impairments. Examples of unscheduled impairments include occupational diseases, hip injuries, shoulder or back injuries, a combination of impairments, or a history of past claims for impairments.

For unscheduled impairment disabilities, the ICA will decide how much compensation you will receive, if any, based on the effect your injury has on your ability to go back to work and how much you would be able to earn compared to what you used to earn before the disability.

In making its decision the ICA will consider your age, your education, your prior occupations, your physical limitations, and what your post-injury wages have been.

Unscheduled Permanent Partial Impairment Benefits

The ICA will calculate workers’ comp unscheduled permanent partial compensation according to the following formula. It is 55% of the sum of:

[Your average monthly wage]

minus

[How much the ICA estimates you will be able to earn as reduced earning capacity]

Unscheduled Permanent Total Impairment Benefits

If the ICA determines that your unscheduled impairment disability means a total loss of income earning capacity for you, then your unscheduled permanent total disability benefit amount will be two-thirds of your wage, or 66 and ⅔ percent of your average monthly wage before the workplace accident.

Frequently Asked Questions

Q: What if the workers’ comp average monthly wage is inaccurate?

Your average monthly wage (AMW) determines the amount you will ultimately receive in each workers’ compensation check. Making sure the ICA gets your AMW right is critical to receiving the maximum benefits you deserve.

The ICA gives you 90 days to dispute the Notice of Average Monthly Wage if you believe that it is incorrect. You have the right to request a hearing before an administrative law judge, who will decide if the notice is correct.

Q: What if I recently started working? How does that affect my workers’ compensation average monthly wage?

If when calculating your average monthly wage your employer does not have wage information from your last year of employment, then the average monthly income amount is typically the amount of your wages earned within the last 30 days, regardless of whether these included work for a former employer.

Q: What if my employer or its insurance company disputes my claim?

Employers and workers’ compensation insurance providers can contest workers’ compensation coverage and claims for any of several reasons. For example, the employer may dispute whether your injury or illness is work related, or claim that you were engaged in horseplay or other misconduct when the injury occurred that would preclude you from making a benefits claim, or claim that you missed an important deadline to preserve your claim.

If the employer’s dispute leads to the ICA denying your workers’ comp insurance claim, then you will receive a Notice of Claim Status from its insurance company that will inform you of the decision and give the reasons for it. If you receive this notice, you have 90 days to appeal the decision to the Industrial Commission of Arizona.

Injured workers in Arizona have certain rights afforded to them under the state’s workers’ comp law. If your employer is unfairly disputing your work related injury or work related injury claim, or there are issues with the workers’ compensation insurance company or the ICA, you should contact an experienced workers’ comp attorney immediately.

Arizona Workers’ Compensation Lawyers Serving You

The workers’ compensation settlement information above can give you an estimate of how much you might be able to receive for a work injury claim. To gain a better understanding of how workers’ compensation disability works, and to ensure that your workers’ comp settlement includes everything you are entitled to make a claim for, including lost wages and your medical expenses, we recommend that you contact one of our workers’ compensation attorneys at (800) 229-3880.

Arizona workers’ compensation law does not require employees to have a lawyer to file a claim. Remember, however, that not having an experienced workers’ compensation benefits lawyer will not excuse you from complying with all the rules and regulations involved in making a benefits claim, including the rules of procedure for hearings before the ICA.

It can be harmful to your workers’ comp claim to learn by experience, especially if that experience comes from making costly mistakes.

At the Matt Fendon Law Group, our workers’ compensation benefits lawyers know how to navigate an Arizona workers’ comp case through all the benefits schedules and regulations to make sure you receive a fair settlement for your claims, including lump sum payments under Arizona’s full and final workers’ compensation insurance law.

Don’t leave calculating workers’ comp benefits to chance:

- We offer free initial consultations for workers’ compensation claims, and we are available by telephone 24 hours a day, seven days a week.

- For your convenience, we have law offices in Phoenix, Scottsdale, Prescott, Tucson, and Flagstaff.

If you prefer to communicate with us online to ask a question about your workers’ compensation claim, you can reach us here.

Don’t let the complexity of Arizona workers’ compensation laws, or of calculating workers’ comp benefits, keep you from filing a claim for disability benefits. Put the Matt Fendon Law Group on your side today.